Tax Deductions Your Tax Preparer Can Suggest

4 Basic Tax Deductions You Might Qualify For

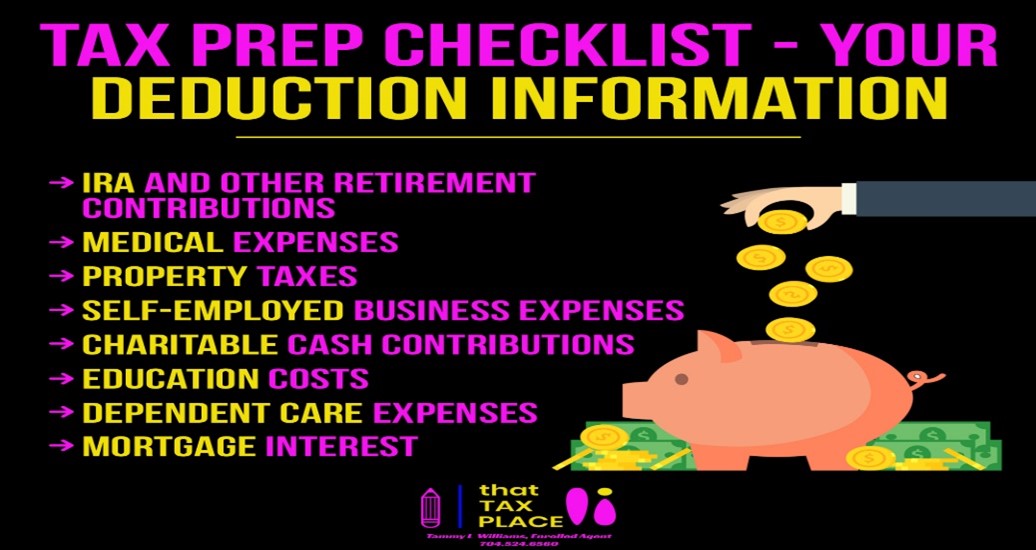

When it comes to your taxes, it’s important to be aware of all the deductions and credits that you may be eligible for. These deductions can help lower your tax bill and increase your refund. In this blog post, we’ll look at four tax deductions that you may be able to claim on your tax return. Always check with your tax preparer to understand those you might qualify for.

- Home office expenses: If you work from home, you may be able to claim a home office deduction. This deduction allows you to deduct a portion of your rent, mortgage interest, utilities, and other expenses related to the use of a portion of your home as an office. To qualify for the home office deduction, you must use the space exclusively for business and it must be your principal place of business.

- Charitable donations: If you make charitable contributions to a qualified organization, you may be able to deduct the amount of your contribution on your tax return. This can include donations of money, property, or even volunteer work. It’s important to keep detailed records of your donations, including the name of the organization, the receipt from the organization, copy of the check, the date of the donation, and the amount of the donation.

- Education: Taxpayers who pay for higher education may be able to take advantage of education tax deductions such as the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit. These deductions can help offset the cost of tuition, fees, and other education expenses. Additionally, students and parents can deduct student loan interest up to $2,500.

- Medical expenses: For tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2023 adjusted gross income. So, if your adjusted gross income is $40,000, anything beyond the first $3,000 of medical bills — or 7.5% of your AGI — could be deductible. This can include expenses such as doctor visits, prescription drugs, and hospital stays. Keep in mind that you’ll need to itemize your deductions to claim these expenses.

It’s important to note that not everyone will qualify for all these deductions, and the eligibility and amount of deductions may change from year to year. Be sure to check with your tax preparer to find out what deductions you qualify for. Keep in mind that these deductions are subject to change as per the tax laws and regulations, so it’s better to stay updated.

It is always a good idea to keep up with expenses throughout the year because circumstances can change, and even if in years past you could not claim these expenses you could during the current year. Tax preparation requires analyzing each individual every year, and your tax preparer knows the changes in deductible expenses. At that TAX PLACE yearly education reviews all the upcoming deductions for you!