Do you Have to Pay Taxes on a Gift?

You may be wondering if the gifts you receive from family and friends will be subject to income tax. As with all thing’s taxes, it depends! But most will never pay a cent in gift taxes to Uncle Sam.

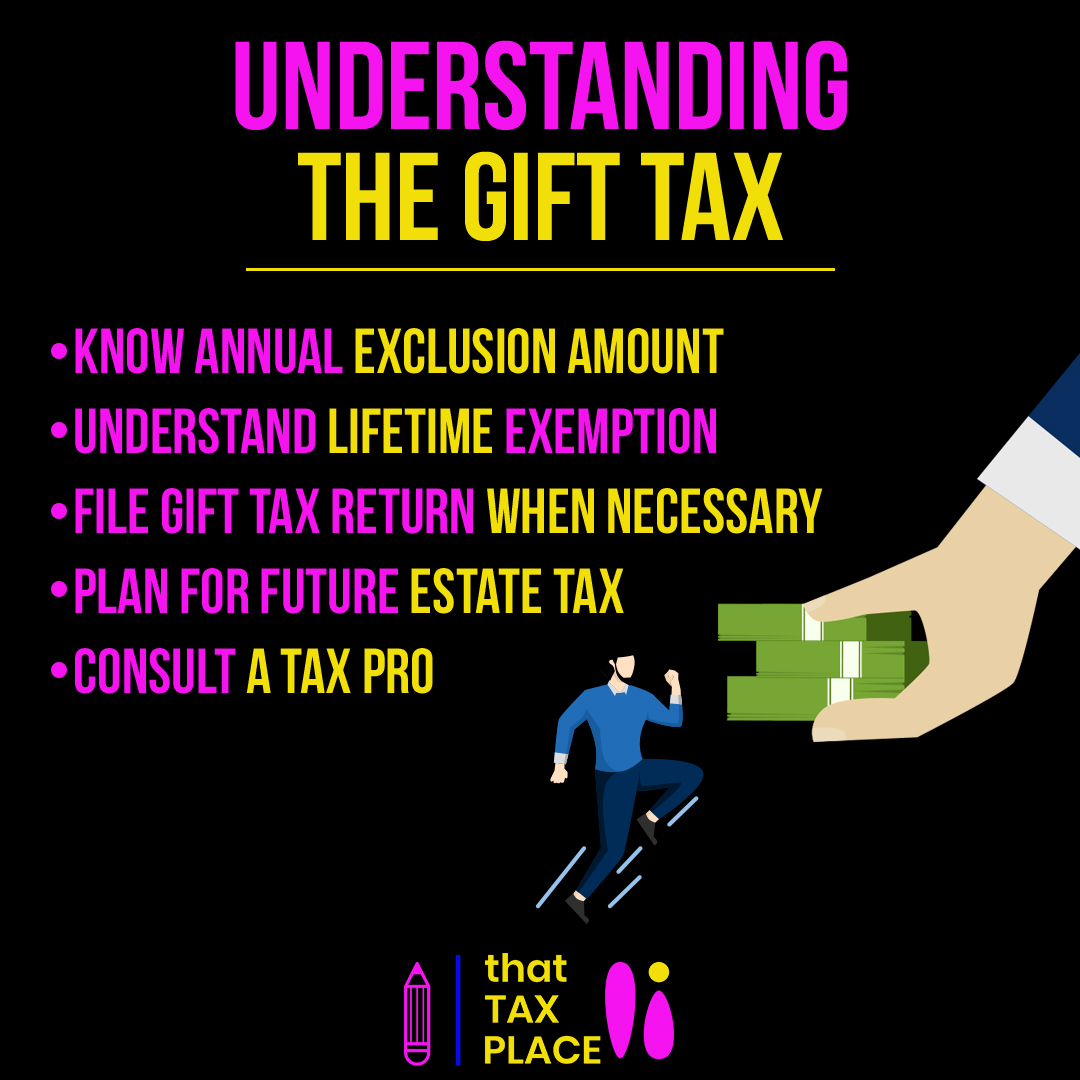

The basics: for 2023 the annual gift tax exclusion for 2023 is $17,000 per recipient. For 2023 a person is allowed a lifetime exemption limit of $12.92 million dollars. The gift tax exclusion is cumulative. It’s important to note that the gift tax applies to the giver, not the recipient. Unless you are one of those people with millions of dollars to give away – the gift taxes will not affect you.

It’s also worth noting that there are a few exceptions to the gift tax rule. For example, gifts given to a spouse, or a dependent are not subject to the gift tax, as well as these:

Certain gifts are entirely free of tax, including:

- School tuition and education payments

- Charitable donations

- Medical expenses

- Political contributions

Always let your tax preparer know of such gifts so that you are compliant with filing requirements. that TAX PLACE can advise you of your responsibilities with filing taxes including the gift tax requirements.