Information on BOI Reporting for US Companies

Effective January 1, 2024, certain entities (referred to as “reporting companies”) must report certain information about their beneficial owners to the US Department of Treasury. This filing is not an accounting or tax-related submission. Even though we cannot file these reports on your behalf, we wanted to ensure that you are aware of this new requirement and have the tools you need to submit it.

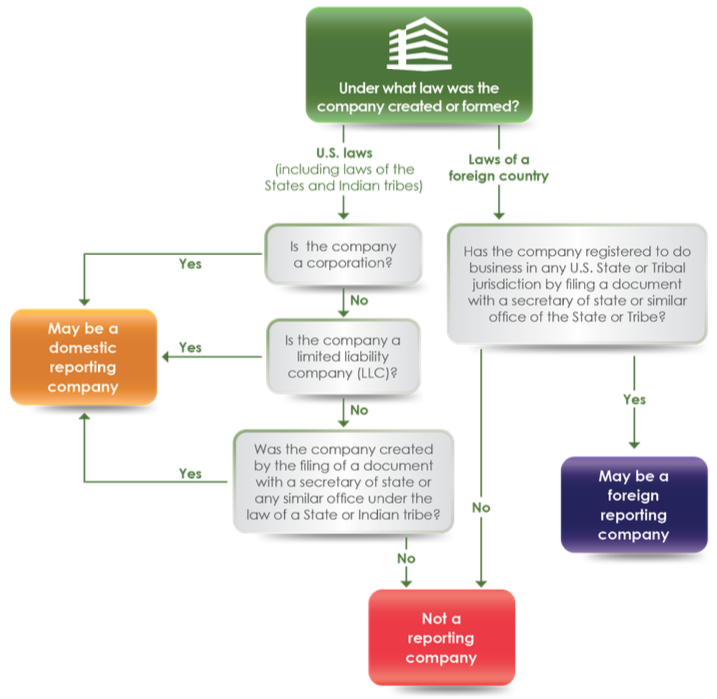

The Corporate Transparency Act (“CTA”) implemented this new requirement to provide increased transparency of those conducting criminal activities, including money laundering, drug trafficking, and other crimes. Those entities who must file include domestic businesses who are created under a state secretary of state office or foreign organizations who are registered to do business in the US. There are several exceptions to filing, such as being required to file various other submissions to the US government, being qualified as a tax-exempt organization, or meeting certain income level and employment levels.

The reporting is referred to as a Beneficial Ownership Information (“BOI”) report. This report will disclose the name, date of birth, and address of each beneficial owner or company applicant. It will also require a form of identification for everyone listed, such as a driver’s license. The report must be submitted electronically on the FinCEN website. The due date of the filing depends on the creation date of the business, as follows:

- If created or registered to do business before January 1, 2024, the entity will have until January 1, 2025, to submit its initial report.

- If created during 2024, the entity has 90 days after creation to submit its initial report.

- If created on or after January 1, 2025, the entity has 30 days to submit its initial report.

The report is not required to be filed annually but is required to be updated within 30 days of any change in the disclosed information.

There are penalties for failing to comply with this requirement, including a $500 per day fine (up to $10,000) and/or potential imprisonment (up to 2 years).

For more information on this new requirement, you may visit https://www.fincen.gov/boi. We also encourage you to contact your attorney for assistance with the reporting.